During this time, it may be somewhat comforting to remember that you are not alone. Everyone is wondering what the immediate future holds for the impact of the COVID-19 virus. Everyone else has the same fears and anxiety that you are feeling right now.

When it comes to investing in your retirement plan, all you can really control is how you react. Sticking to sound,

fundamental investing principles and staying the course will help you make it through this difficult time. Here are some practical tips for surviving market volatility in the face of what may seem like an extraordinary crisis right now.

Avoid Hitting the Panic Button

During this time, it’s very tempting (and very normal) to think about getting out of the stock market. Especially on March 16, when the S&P 500 suffered its worst decline since the 1987 stock market crash (also known as Black Monday). But selling solely because the stock market has suffered a big decline over a very short period of time may be the worst thing you can do.

It’s understandable if you’re struggling to keep fear in perspective right now. Over time, however, the stock market has historically risen despite significant economic challenges, terrorism, the burst of the housing bubble in 2008 and countless other calamities. Investors should try to always separate their emotions from the investment decision-making process. What seems like a massive global catastrophe one day may likely become a distant memory a few years down the road. After all, when

was the last time you thought about Black Monday (if you are even old enough to remember it)? Or the Great Recession?

Keep a Long Term Perspective

For many people, a retirement account is their largest investment asset. And that’s probably the asset you are most concerned about right now. Keep in mind that if you are investing for a long-term goal such as retirement, which may not begin for two or three decades — and could last two or three decades — you will have plenty of time to ride out this current market downturn.

Staying Invested in the Stock Market: A Very Recent History Lesson

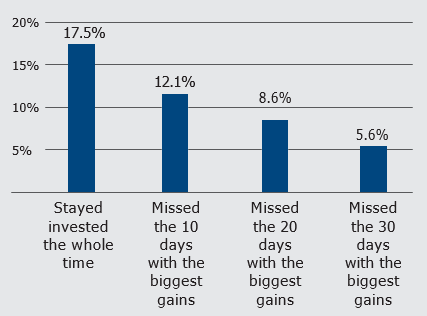

Back on March 9, 2009, the S&P 500 Index hit its financial crisis low. Ten years later, on March 8, 2019, the index’s total return over that time was 400.1%, or 17.5% per year. However, if you missed the 20 best percentage gain days over that 10-year bull run, the annual gain was cut in half to 8.6%. The chart below shows that pulling money out of the market — even for just a few weeks — could really cost you in potential investment gains.

Annualized Total Returns

Excluding Total Number of Top % Gain Days in Period March 9, 2009 – March 8, 2019

Maintain a Diversified Portfolio

Having a percentage of your portfolio spread among stocks, bonds, and cash assets is the core principle of diversification. Doing so helps manage your risk because historically not all parts of the market move in the same direction at the same time. Losses in one asset category (such as stocks) may be mitigated by gains in another (such as bonds and cash)1.

Big Picture Perspective

January 1, 2000 – Dec. 31, 2019

S&P 500 delivered an average annual return of 7.68%.

Bonds (Bloomberg Barclays US Aggregate Bond Index) delivered an average annual return of 5.08%.

Stable assets (90 day T-bills) delivered an average annual return of 1.79%.

Inflation (comprised from the Official Data Foundation ) has averaged 2.17% a year.

Source: Kmotion Research, Callan Institute, https://www.callan.com/periodic- table/. Past performance does not guarantee future results.

Consider This a Great Buying Opportunity Experienced investors often view bear markets as great buying opportunities because the valuations of good companies get hammered down due to circumstances beyond their control — such as what is happening now with the airlines, hotels, oil companies and many other industries

and sectors. If you can afford to, it’s important to keep contributing to your retirement account on a regular and consistent basis.

Keep on Dollar Cost Averaging

The principle of dollar cost averaging means you simply commit to investing the same dollar amount on a regular basis (like you are already doing with your retirement plan). When the price of shares in a stock or investment portfolio drops (like it is now) — you’re actually buying more shares. Conversely, when the price goes up, you’ll be buying fewer shares. Over the long term, this provides you with an opportunity to actually lower your average cost per share2.

Be Real About Your Tolerance For Risk

When you started saving for retirement, you may have taken a quiz to help gauge your comfort level with risk and chose investments accordingly. Whatever you did, you probably never thought it would be tested like it is right now. If you are literally not able to sleep at night right now due to all the market volatility, that’s probably the most reliable sign that you may need to consider a larger allocation to more conservative investments. However… make sure you consider the next and final tip before you do anything!

Think, Reflect, Sleep on it….and Consider Talking to a Financial Professional

If you make changes to your retirement plan investments, do so in a thoughtful way and after careful consideration.

Talk to friends and family (remember, they’re in the same situation as you are). Read and digest articles from a trusted financial news source. And if you haven’t already, consider talking to your plan advisor to get their perspective and guidance.

1 There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

2 Dollar cost averaging involves continuous investment in securities regardless of fluctuation in price levels of such securities. An investor should consider their ability to continue purchasing through fluctuating price levels. Such a plan does not assure a profit and does not protect against loss in declining markets.

Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Private Advisor Group, a registered investment advisor. Private Advisor Group and Retirement Legacy Group are separate entities from LPL Financial.

The LPL Financial Registered Representatives associated with this site may only discuss and/or transact securities business with residents of the following states: AZ, CA, CO, FL, GA, IL, IN, MI, NY, OH, OK, PA, TX, and VA.

This material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL Financial affiliate, please note LPL Financial makes no representation with respect to such entity.

| Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value |